https://www.wemakescholars.com/education-loan/education-loan-emi-calculator-comparison

Education Loan EMI Calculator Comparison

✓ Benefits of Education Loan EMI Calculator

✓ Problem with most education loans EMI calculator

Table of content

- What is an Education Loan EMI calculator?

- Benefits of using the education loan EMI calculator

- SBI Education Loan EMI Calculator

- Bank of Baroda Education Loan EMI Calculator

- PNB Education Loan EMI Calculator

- HDFC Bank Education Loan EMI Calculator

- Axis Bank Education Loan EMI Calculator

- Auxilo Education Loan EMI Calculator

- Avanse Education Loan EMI Calculator

- Problem with most education loans EMI calculators

- FAQ's

- Need Help? Ask Here!

HEST 2025

India's Largest Higher

Education Scholarship Test

Total Scholarships up to 2 Cr

Know more and Apply

Registrations close in

Taking out an education loan is no joke! An education abroad costs no less than 15-20 lakhs and goes as high as 1-1.5 Cr.

So, when a student takes an abroad education loan, he/she also takes up the responsibility of repaying the loan in due time; after all, no one takes out a loan with the intention of not paying it back.

A successful education loan repayment necessitates prudent planning, which you can only do if you have the knowledge of how to finance and budget properly.

To help you budget properly, banks have come up with their education loan EMI calculators on their respective websites. The education loan EMI calculator is an online tool that allows you to calculate how much money you will have to pay every month towards your education loan. The online calculators provided by various lenders are designed as per their respective repayment policies.

This article will provide you with a detailed comparison of the education loan EMI calculators of each of these major education loan lenders. By the end of this article, we'll also tell you the problems with these calculators and provide you with the solution for the same which is the Education loan EMI calculator by WeMakeScholar. How is the EMI calculator by WeMakeScholar better than the rest? Read till the end to understand the difference properly.

Also Read: How to Payoff Education Loan Quickly- Know All The Tips

What is an Education Loan EMI calculator?

An education loan EMI calculator is an online tool that can help students to calculate the EMI accrued on their education loans, otherwise known as the Equated Monthly Installments.

EMI is generally fixed for the entire tenure of your loan and has to be paid on a monthly basis over the repayment tenure of the loan. During the initial years of your repayment tenure, you pay more towards interest, and gradually, as you repay the loan, a higher portion is adjusted towards the principal component.

The traditional way to accomplish this task would be to use the EMI formula and spend a lot of time doing the calculations. But the same task can be accomplished much faster and more accurately by using an online EMI calculator.

An education loan EMI is calculated by taking into account three important parameters, Principal amount, Annual interest rate, and total loan tenure. Most education loan EMI calculators calculate the EMI based on the equation

EMI = P × r × (1 + r)n/((1 + r)n - 1)

where,

- P= Loan amount

- r= interest rate

- n=tenure in number of months

Benefits of using the education loan EMI calculator

- Quick Results – Students can easily use this calculator to calculate the EMI that they will be liable to pay for a predetermined tenure and the rate of interest that the education loan is offered, in just seconds.

- Simplicity – The calculations using this EMI calculator are based on the students providing three key bits of information i.e. the principal amount of the loan, the applicable rate of interest, and the loan tenure.

- Varying Combinations – With the educational loan EMI calculator, you can easily input different interest rates and tenures to look for a combination that will allow you to easily repay the principal amount, without putting undue pressure on your finances.

- Free Usage – The education loan EMI calculator is available to everyone free of charge and is easy to use.

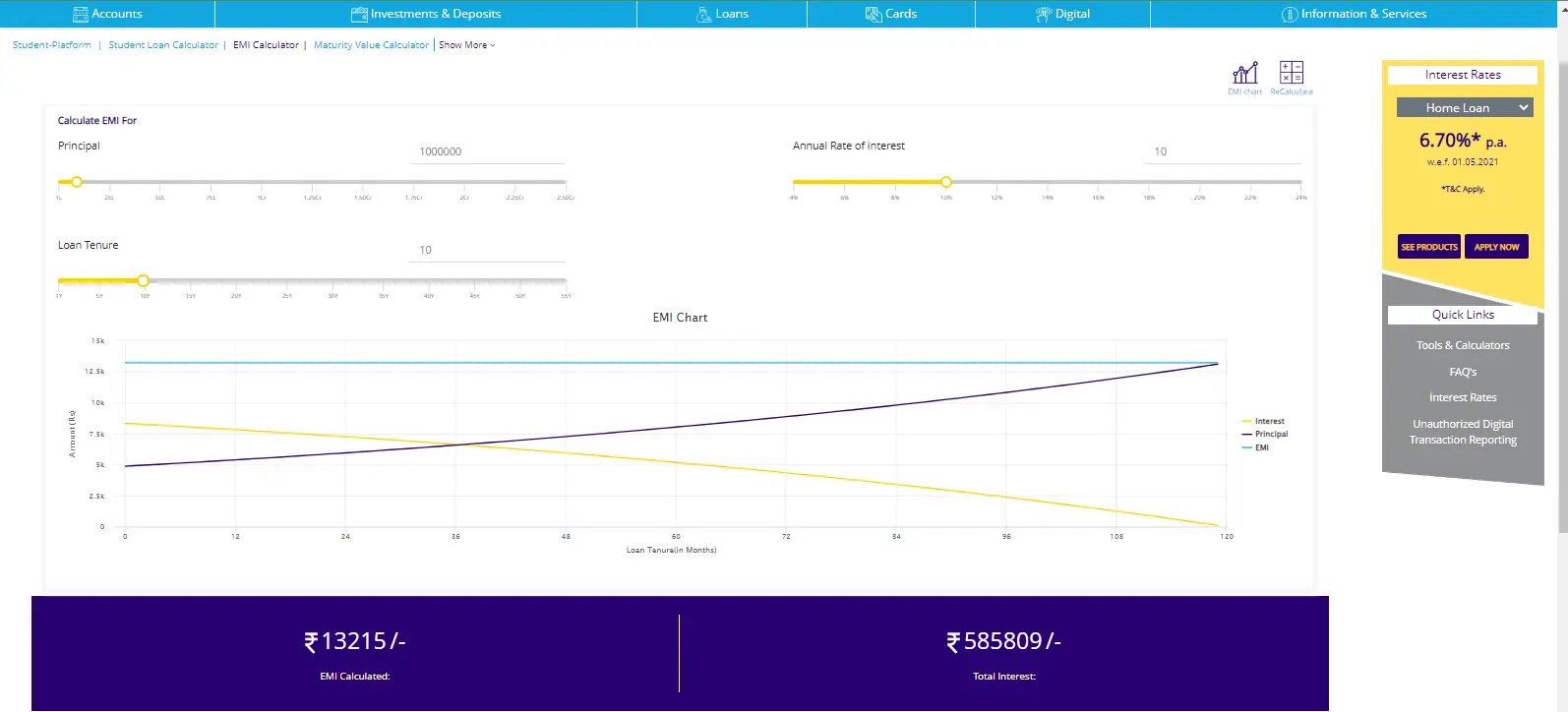

SBI Education Loan EMI Calculator

SBI is at the forefront of the banking industry in India. Hence, it is quite understandable when students choose to borrow student loans from the SBI. The education loan policies drawn by the SBI are quite on the student-friendly side; hence, the bank's education loan schemes offered by the bank are often favoured by students.

When students fill each of the above parameters into the fields provided in the SBI education loan EMI calculator, the results are displayed below the page in two different formats, the total interest applicable and the monthly amount to be paid by the student. Additionally, students can click on the "EMI chart" in the top right corner to get a graphical representation of how much they'll be paying the interest rates and the principal amount.

The online platform of SBI also offers some additional tools like "Repayment schedule" and "Prepayment Calculator" which you can assess by clicking on "Show More".

Bank of Baroda Education Loan EMI Calculator

On the official website of the BOI, there is an education loan interest rate calculator which students can refer to find out the EMIs calculated on their education loan during the repayment period.

The Bank of Baroda education loan EMI calculator is more or less similar to the other education loan EMI calculators.

The problem with the Bank of India EMIs calculator is that it’s not as user-friendly and comprehensive as some other EMI calculators out there.

PNB Education Loan EMI Calculator

Punjab National Bank (PNB) offers different educational loan schemes as per need at attractive interest rates, and students may get overwhelmed while calculating how much EMI they need to pay back to the bank once their repayment period commences.

You will not find a PNB education loan calculator on the official website of PNB but for home and car loans which does the same calculation.

HDFC Bank Education Loan EMI Calculator

The education loan EMI calculator by HDFC helps you determine your monthly instalments as per the specified tenure, applied interest rates & course type.

The downside with the HDFC education loan calculator is that it limits the amount to 10 lakhs, meaning you can not calculate EMIs for amounts more than 10 lakhs.

Axis Bank Education Loan EMI Calculator

The EMI calculator by Axis Bank education loan is just like any other EMI calculator, and unlike the HDFC education loan calculator, you can calculate the EMI for loan amounts up to 5 crores.

Auxilo Education Loan EMI Calculator

Auxilo is one of the NBFCs that also provide education loans to students and so they too have an EMI calculator on their website. Auxilo education loan has also listed a loan repayment calculator which helps borrowers to modify their current education loan repayment plan.

The downside with their EMI calculator is that the lowest you can go in interest rates is set at 11.5%.

Avanse Education Loan EMI Calculator

Avanse is also an NBFC that also provides education loans. Likewise Auxilo EMI calculator, the lowest interest rate is set at 10.5%, and the loan repayment tenure calculation for the Avanse education loan is for 10 years only.

Problem with most education loans EMI calculators

It is important to understand that the education loan EMI calculators of most lenders are based on the repayment policies which do not include a moratorium period and the calculation of the interest amount being made on the basis of compound interest.

As per RBI, lenders must give a grace period to students before commencing their repayment period. The grace period or moratorium period is usually the course duration plus 6 months and can extend up to 12 months where students are not required to pay anything to the bank.

All Public banks like SBI, BOB, etc offer students a no-payment moratorium period, on the other hand, private banks and NBFCs ask for partial or full interest to be paid during the moratorium period.

So, the problem with most EMI calculators is that they do not take into account the moratorium period while calculating the EMIs which gives students inaccurate results.

Solution? Education loan EMI calculator by WeMakeScholars, which shows accurate and detailed results and assists you to plan your monthly EMIs.

As you may have noticed from the above images that those calculators don't have parameters like- course duration, moratorium period-related details (factors that determine the loan EMI), etc, WeMakeScholars EMI calculator calculates the actual repayment considering your moratorium period, partial disbursements, and more.

Here is the link to your solution- Education Loan EMI Calculator by WeMakeScholars.

The financial team of WeMakeScholars has been interacting with both public and private lenders on a much deeper level in order to facilitate an easy education loan process for most of its applicants. If you have any doubts regarding the same, feel free to reach out to our team for efficient guidance and counsel.

FAQs:

FAQs:

-

What is an Education Loan EMI Calculator?

-

What are the benefits of using the WeMakeScholars Education Loan EMI Calculator?

-

How can I trust the WeMakeScholars Education Loan EMI Calculator?

-

Can I compare different loan options using the WeMakeScholars Education Loan EMI Calculator?

-

Is the WeMakeScholars Education Loan EMI Calculator user-friendly?

WeMakeScholars- supported by IT Ministry, Govt. of India.

Our Education Loan team will help you with any questions

Kindly login to comment and ask your questions about Education Loan EMI Calculator Comparison